Ken Boessenkool: Dear Doug Ford: Why let Trudeau buy off his voter coalition when you could be buying off yours?

In an imaginary memo, some strategic tips to embattled Ontario premier Doug Ford.

By: Ken Boessenkool

TOP SECRET Memorandum

To: Premier Doug Ford

From: Your Re-election Team

cc. Provincial Treasurer Peter Bethlenfalvy

Re: Why let Trudeau buy off his voter coalition when you could be buying off yours?

Executive Summary

Prime Minister Justin Trudeau’s carbon rebates help fewer federal Conservative voters than non-Conservative voters. In particular, Trudeau is using carbon rebates to lure NDP and Green voters at the expense of Federal Conservative voters. Now that you’ve lost the Supreme Court case and this tax is here to stay, own it. Take this tax and restructure the rebates to benefit our suburban and rural voting coalition.

Background

The federal government is imposing a carbon tax in Ontario and using the proceeds to provide rebates to Ontario residents. About 90 per cent of federal fuel charge revenues are returned to households through income tax rebates in a “Climate Action Incentive.” Those rebates are largely based on income and family size. There is also a 10-per-cent top-up for rural residents.

There are two challenges with this system. First, the rural surcharge does not adequately cover the additional costs faced by rural residents. Second, suburban residents — basically all non-rural residents who live outside Ontario’s 19 largest cities including Toronto, Ottawa, Peterborough, Hamilton and Barrie — have higher fuel costs than urban residents, but don’t receive additional rebate to recognize those higher costs.

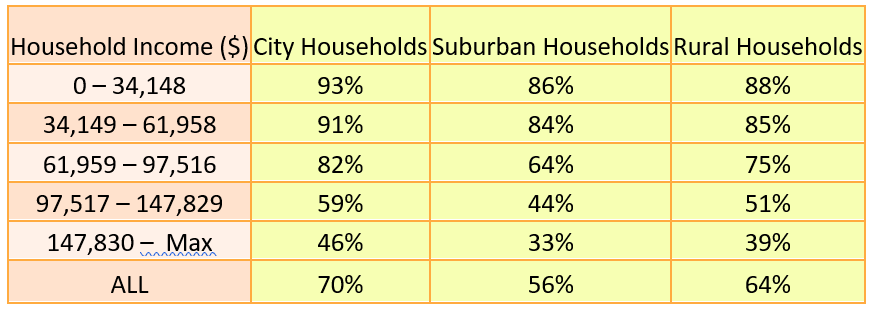

Statistics Canada’s consumer spending data measures carbon tax paid over which we can overlay the value of rebates for Ontario households. The table below segments Ontario residents by income quintiles and geography. It shows the percentage of residents in each group that receive larger rebates than they pay in carbon tax.

A few things jump out from this table. First, if you live in the city, you are much more likely to be better off with this system: 70 per cent of residents in Ontario cities receive larger rebates than they pay in carbon taxes. Second, the rural rebates mean that suburban residents are worse off than rural residents. Finally, and not surprisingly, a larger number of households with lower incomes are better off than households with larger incomes.

The Problem

Your campaign team thought the distribution of Justin Trudeau’s rebates in Ontario was curious. It seemed to us that our voter coalition of rural and suburban residents are, on balance, worse off. So we decided to overlay the distribution of votes in Ontario with who gets ahead with the carbon tax rebate.

What we learned surprised us. Either Justin Trudeau and his team are exceedingly lucky, or they are exceedingly brilliant. We’ll let you guess, but whichever it is, what we learned is bad news for you.

After weighting number of households and voting behaviours, we found that only 66 per cent of federal Conservative Party of Canada voters were ahead with the carbon tax rebate. That compares to 69 per cent of Liberal voters, 73 percent of NDP voters, and 75 percent of Green voters.

Our first reaction was likely the same as yours, “You mean the biggest number of beneficiaries of Trudeau’s policy are NDP and Green voters? Say what?”

That’s not the right way to look at this, however. Liberal voters are already voting Liberal. NDP voters and Green voters are the ones that need to be persuaded. And Green voters are most likely to vote entirely on climate issues — and Trudeau has made 75 percent of them better off! The largest group of voters benefiting from Trudeau’s carbon rebates are the ones most likely to have carbon policy affect their vote. We’re leaning away from luck and towards brilliant.

The Solution

Now that you have lost the Supreme Court reference, the carbon tax is here to stay. You can either let Justin Trudeau continue to use the revenues to his advantage, or you take take over the revenues and do the same.

We recommend that you make two adjustments to make the tax fairer to Ontario residents (and your voters). First, you should increase the rural top-up from 10 per cent to 15 per cent. Second, you should lower the gasoline and diesel excise taxes to ensure that many more suburban households (especially the ones that vote for you) are better off.

This will likely generate howls of protests, but there is a good response. The current excise tax on gasoline in Ontario is equivalent to a carbon tax of over $100/tonne and the current excise tax on diesel is equivalent to over $60/tonne. In 2022 the carbon tax is going to $40 per tonne, so the current excise taxes are already a higher carbon tax than what is planned.

Summing Up

Justin Trudeau’s carbon tax and rebate is either brilliant, or lucky. We’ll let you decide which. But whatever it is, we have an opportunity to make the tax “fairer” to Ontario residents in ways that will make you both brilliant and lucky. Let’s do it.

The Line is Canada’s last, best hope for irreverent commentary. We reject bullshit. We love lively writing. Please consider supporting us by subscribing. Follow us on Twitter @the_lineca. Fight with us on Facebook. Pitch us something: lineeditor@protonmail.com