Nick Kadysh: Canada's new gilded age

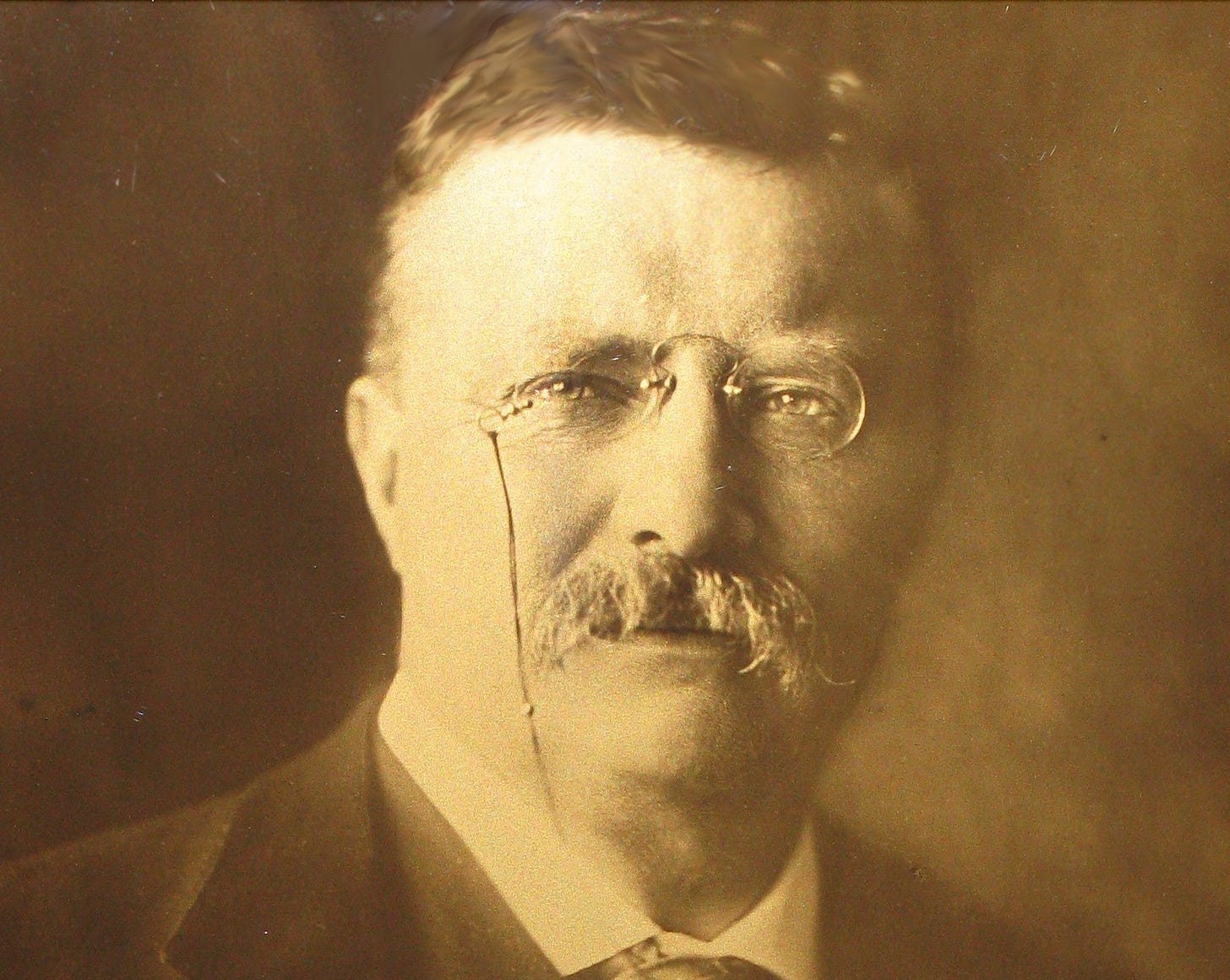

We need a Teddy Roosevelt to save us from the rings strangling our prosperity

By: Nick Kadysh

Mark Twain, a product of the Gilded Age, is said to have quipped that “History doesn’t repeat itself, but it does rhyme.” Much ink has been spilled over the past few years about what historical comparisons to make about Canada in the modern day. Are we living through the inflation crisis of the 70s? The housing crash of the 80s? Is it the Roaring Twenties, back again? These comparisons are important, because they inform the policy approach that government must take.

In Canada, as we suffer through rapidly slowing labour productivity and a major cost-of-living crisis, I think the correct comparison is clear: We are actually living through another Gilded Age. This period in U.S. history, stretching from roughly 1875-1900, brought great wealth from industrialization. Similarly, Canada had a brilliant run, gaining the benefit of the revolution in information technology. We avoided the recession of 2008 quite well. But just like U.S. at the end of the gilded age, the Canadian economy has grown stagnant with the weight of the accumulated vested interests created by our economic run.

Across the economic landscape, whole sectors are held captive by monopolistic entities. Oligopolies control our telecommunications, our food supply, our transportation networks. Entrenched labour interests hold vital ports hostage. NIMBY sentiment prevents infrastructure and housing construction. By the end of the gilded age these were known as “rings” — monopolistic consortia of capitalists and bankers that controlled coal, the railroads, all of the necessary elements of commerce.

It has become self-evident that Canada is truly under the control of our own modern-day rings. After all, we’re a country where the competition commissioner is punished for daring to intervene in the Rogers/Shaw merger.

These rings are the reason our economy stagnates. The Dairy Council ensures that our milk stays expensive — but they also ensure that our dairy industry cannot compete internationally. Our transportation rules forbid low-cost carriers from entering the country, and claim this is necessary in order to subsidize rural flights across Canada — rural flights such as Calgary-Ottawa, recently cancelled by Air Canada. The Port of Montreal has faced a strike every single year since 2020; each stoppage disrupts supply chains, increases the cost of goods and adds to the challenges faced by regular people, and each strike is designed partly to ensure that the port is not modernized.

The effect of each ring on the average Canadian may not be very noticeable, but the effect of all of the rings together is palpable: poverty, stagnation, and ultimately human suffering.

The main difference is that in the gilded age, the government was a bystander. Intervention in the economy was considered improper, and so the U.S. federal government stood by. Today in Canada, our problem is very different: today, the federal government is an active participant in enforcing monopolistic compacts in transportation, in food production, in telecommunication. Ottawa subsidizes these companies with public dollars, and entrenches them with regulatory beneficence that keeps competition down. This is the major reason for our loss of productivity. The federal government has become so captured by monopolistic thinking that its idea of an industrial strategy is to create new oligopolistic entities, named superclusters. We’re literally living in an age of robber barons, and rather than being on the side of individuals, the government has sided with the monopolists.

The moment of change during the original gilded age was the assassination of William McKinley in 1901 and the ascendance of Theodore “Teddy” Roosevelt to office. His solution was to make the government an active participant; in the Anthracite Coal Crisis, Roosevelt — despite having no constitutional authority to intervene — decided that in addition to the trade unions, who wanted higher wages, and the coal barons, who wanted higher profits, there was another party: the thousands of Americans who would freeze to death if the standoff continued.

“Populism” often gets a bad name, but here is the very heart of positive, populist action: vested interests cannot be the only voices heard in federal and provincial capitals. The alarming rise in food bank use speaks to the suffering going on amongst regular people across Canada, but it seems clear that at the federal level the government is more interested in using our competition bureaucracy to score political points than to fight for the interests of average Canadians, as was recently the case when the innovation minister publicly weighed in in support of a complaint before the commissioner his ministry selects and appoints.

Our political class would be wise to listen, however. The end of the gilded age brought about an age of mass income inequality, and much attendant violence. This violence was cultural — inspiring stories like that of Bruce Wayne, whose wealthy parents are murdered by a poor criminal — but this violence ultimately became political. McKinley was assassinated; Teddy suffered a gunshot wound in an assassination attempt himself (launching one of the finest political speeches in history).

In order to fix these problems, our federal government — which overwhelmingly bears responsibility for the sectors most controlled by our modern-day rings — must take both action and responsibility. This goes well beyond un-muzzling the competition commissioner. It’s not easy to take action that lobbyists will fight tooth-and-nail to oppose; vested interests are vested for a reason. But a government truly committed to fighting for individual Canadians would act to reduce the number of oligopolies in our economy, and to open us up to foreign competition. It would act to blunt the power of vested interests fighting startups and progress, whether they be found in the halls of the CRTC regulatory apparatus, or the organized labour movement. They would give out fewer subsidies — which overwhelmingly get seized by large corporations in oligopolistic control of their sector — and issue broad-based reforms which help small business grow both in Canada and beyond.

This work would be dramatically difficult, because it would involve telling some of the most wealthy and powerful people in our country that they need to stop taking advantage of their wealth and power. It would involve the government of Canada reminding our bureaucrats that they work for the interests of the greatest number of Canadians, not the companies they regulate. It would certainly be tumultuous.

But the opposite path, the one we seem to be committed to right now, is that of inevitable strangulation at the hands of the rings. Canada needs a Teddy Roosevelt. Who will that be?

Nick Kadysh is a public policy professional, and founding CEO of PharmAla Biotech Inc.

The Line is entirely reader funded — no federal subsidy for us! If you value our work and worry about what will happen when the conventional media finishes collapsing, please make a donation today.

The Line is Canada’s last, best hope for irreverent commentary. We reject bullshit. We love lively writing. Please consider supporting us by subscribing. Follow us on Twitter @the_lineca. Fight with us on Facebook. Pitch us something: lineeditor@protonmail.com.

I've been reading others thinking along these lines (I find Cory Doctorow and Scott Galloway talk about these themes in an entertaining way). Here's where I think we go wrong from a policy point of view: we tend to elect governments that promise 'good paying jobs for the middle class' and the easiest, fastest way, highest-profile way for them to deliver is to support, subsidize and attract large companies capable of generating lots of 'showcase' jobs quickly. So, government pours money into projects that promise to create good paying jobs, and then is motivated to create a business environment designed to support the companies they've now aligned themselves with to keep those jobs and investment here.

Ultimately, the government gets captured because it's tossed millions (or billions) of dollars into projects for the promise of good-paying jobs and it needs to see returns in a fairly short timeframe.

I think the role of government is to maintain competitive, dynamic and trustworthy markets. That means regulation, including anti-trust and competitive legislation, that keeps lots of entrants and lots of competition. Doing so will make the market more dynamic (which is good) which means job stability might be less (which isn't so good if you are the one impacted). The answer is to develop good programs to help people make the transitions between opportunities -- which can mean retraining and relocation. That's actually good both for workers and the economy over the long term as people shift to places where there are actual opportunities.

That would also require a change in mindset for workers -- recognizing that you are more likely to have to shift from job to job and that you might not be able to find the next opportunity where you are currently living ... which has impacts on housing too.

Now, I'm not saying getting this policy mix is easy -- it's not. It's a lot more like trying to create a really interesting, competitive sports league, where you want to keep each team competitive, allow winning teams to get rewarded, but not so much so that they become unbeatable. It would mean looking at 'sunset' industries and focus more on helping people transition to the next thing and less on propping up inbumbents.

It's very different than the 20th century model, which focused a lot on attracting foreign direct investments (the branch plant economy) where landing a big auto plant would then generate several thousand good-paying jobs and a whole network of suppliers, reliably for decades. I think that model doesn't really work anymore -- the big value in modern companies is data and IP and that tends to accrue value at the head office, not at the 'branch plant' where work can be automated and companies can get governments to compete on subsidies.

My stance on most of this is very much the same as yours - however, I really don't believe our government will ever actively work against those with vested interests in the way things are, unless their influence is blunted by something quite extreme, such as a commercial and/or residential real estate crash, or even a general economic crash (which, let's face it, anything substantial in real estate would cause, here). It's been something of a theme throughout my last three posts on my Substack.

I think something tumultuous must happen first, for our own government to change course, which is currently firmly set on maintaining the status quo. That's because they don't believe the problems you describe are real; they truly think the problem is populists stirring up trouble by stating there are problems.